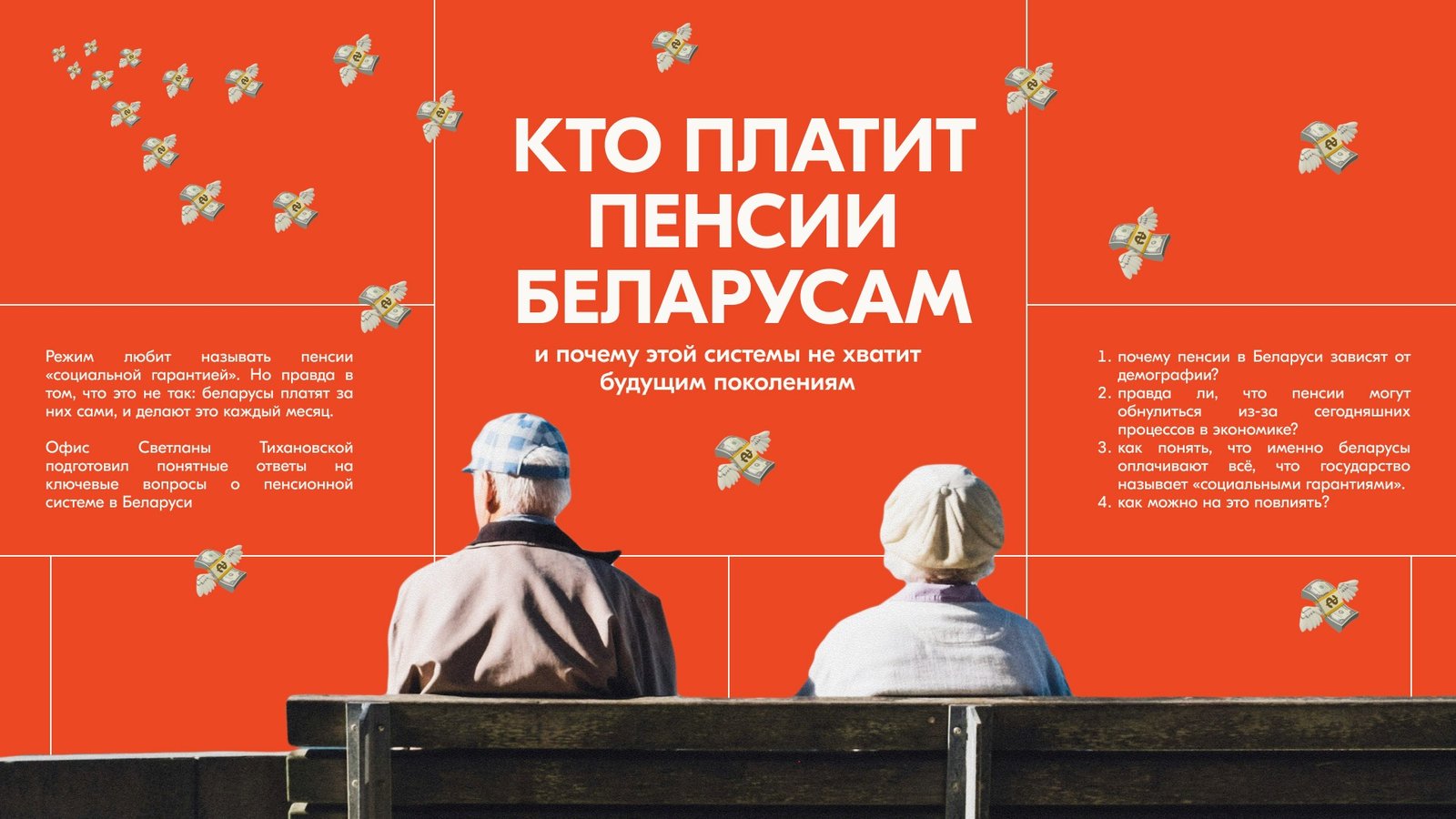

The Lukashenka regime likes to call pensions a “social guarantee”. But the truth is they’re not. Belarusians pay for them themselves, and they do so every month. Sviatlana Tsikhanouskaya’s Office has prepared clear answers to key questions about the pension system in Belarus.

- Is it true that the pension system depends on the number of people?

Yes. Belarus uses a pay-as-you-go (solidarity) pension system. Current workers make contributions to the Social Protection Fund (SPF), which are immediately redistributed to current pensioners.

This system originated in the Soviet Union, when the population was growing.

The main problem now is that Belarus has 4 pensioners for every 10 people of working age. If current trends in birth rates, migration, and mortality continue, by mid-century this number will rise to 6, and by the 2080s to 8 pensioners per 10 working-age people.

Without reform, this means the government will either have to:

- cut pensions in half,

- double social contributions,

- or add 10% of GDP annually to cover the SPF deficit.

- Is it true that Belarusians are being misled and that they pay for everything the state calls “social guarantees”?

Yes. Belarus is not the UAE, Norway, or Russia – it has very few natural resources.

According to the Finance Ministry report (page 18), 85% of 2024 budget revenues came from taxes – that is, directly from citizens and the companies they work for. Another 6% were free-of-charge revenues, which follow the same principle. The remaining 9% were non-tax revenues, much of which comes from the state-owned enterprises, where Belarusians also work.

So yes, citizens themselves are the source of nearly all the money the state uses to fund social benefits.

- How can this situation be changed, and how can the pension system be reformed?

There are several possible approaches to pension reform, but most involve introducing a funded component. That means part of each worker’s contributions would be saved in individual retirement accounts and wisely invested – under strict state oversight. When the person retires, their pension would consist of two parts:

- a base (social/solidarity) portion, and

- an individual funded portion.

This model has been adopted by most developed countries that, like Belarus, face low birth rates. But two key conditions are required:

- Trust between citizens and the government, because these promises will only be realized decades later;

- Trust from international financial institutions, because at the start of the reform, while part of contributions are diverted into savings accounts, the government must still pay existing pensioners. The reform is self-sustaining, though only after 40–50 years. That’s why external financing is essential in the early phase.

Today, Belarus is cut off from international financial markets and has effectively defaulted on its sovereign debt. So financing a large-scale pension reform is currently impossible.

A possible model for reform is described in a project developed by BEROC experts.